The future of financial advisers and insurance agents at a time of rapid worldwide transformation

Years of digital transformation have been accelerated into two months of rapid change in financial advice delivery.

The global economic fallout from COVID-19 means there has never been a more important moment for financial advice than now.

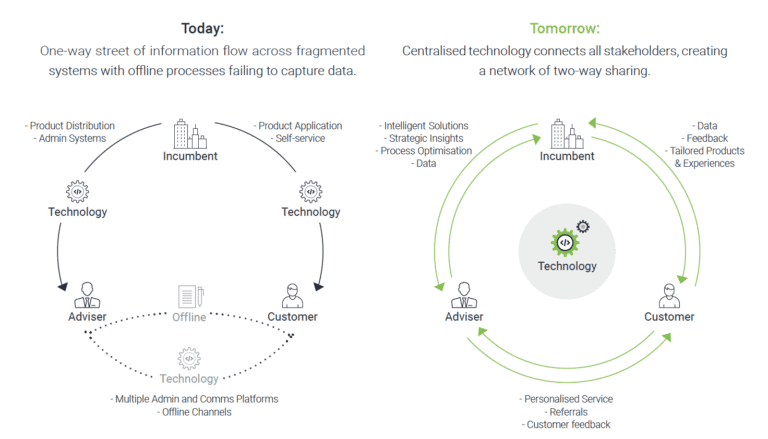

However, the industry needs investment in digital transformation initiatives to meet rising meet customer expectations while continuing to attract new prospects, at scale and efficiently.

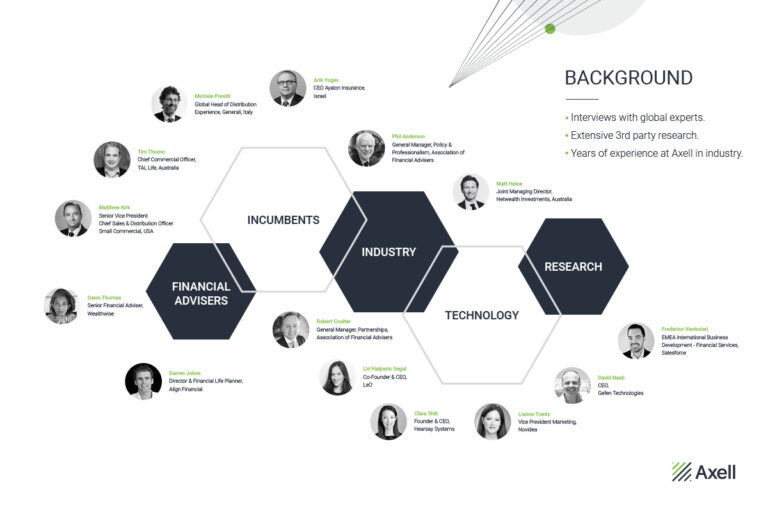

Over the last six months, Axell conducted extensive research and interviews with thought-leaders and industry experts from across the world to understand the future opportunities for digitally transforming financial advice.

Combined with Axell’s decades of experience working on innovation programs within the financial services sector, we’ve published an exclusive, comprehensive research report looking at the future of financial advice from all perspectives in the network.

The report is a call-to-action for insurance and wealth management businesses around the world to invest in technology across the value chain, particularly platforms that facilitate a more personalised connection between adviser and client.

Featuring deep dives into key opportunities and practical, actionable steps for incumbents to take today, the research report is a must-read for all business leaders.

Understanding the financial advice eco-system

In the report, we consider the needs and opportunities of all stakeholders in the ecosystem of financial advice delivery. Some key highlights from the report, include:

- Customers want personal, digital service – human connection in the right channel at the right time is what will attract and retain advice customers.

- Financial advisers of the future – the massive growth and evolution of FinTech combined with human touch will be the competitive advantage of the successful adviser.

- Digital revolution requires incumbents’ leadership – the role of incumbents is to champion an innovation and digital-first mindset, integrate technology and demonstrate its value through education.

- Partnerships with FinTechs will be key – collaboration will shore up resources in preparation for the future. Strategic partnerships will enable both traditional incumbents and newcomers to unlock new scalable opportunities across the value chain.

Read the full report

Download the full report for all the insights and global perspectives on the future of financial advice in a digital world.

Stay connected to us on LinkedIn the latest updates.