Human touch in a new digital world

If the last few months have taught us anything, it’s that quick-fix solutions are no replacement for financial advisors’ traditional ways of lead nurturing and relationship building.

When I initiated a deep research effort into the future of financial advice distribution, I didn’t expect it to become so timely quite this quickly.

The findings, recently launched at Insuretech Connect, are useful for large financial product providers – insurers, wealth managers – that’re currently struggling to support their adviser networks.

But I also know how time-poor everyone is right now; who’s got the time for a bulky report or another videoed conference presentation?

To save precious time, I’ve packed together some of the most pressing takeaways.

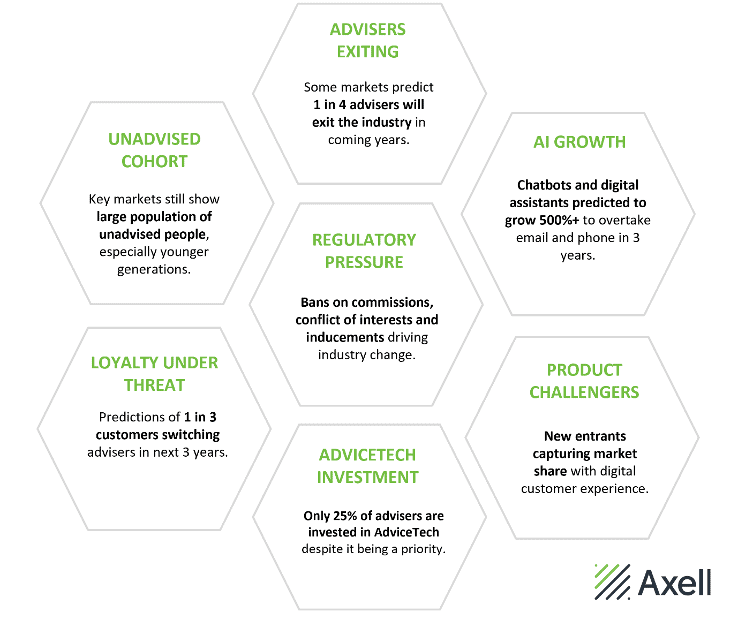

1. Financial Advice was quickly changing even before COVID

The landscape was already changing for advice distribution, with technology’s quick evolution changing customer preferences.

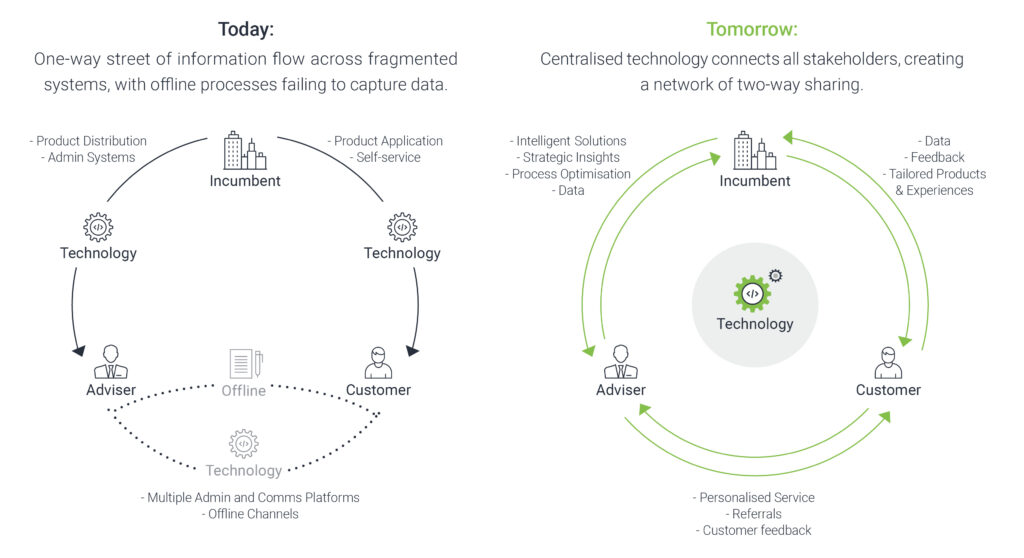

The industry has long been structured as a one-way street of communications:

The incumbent product provider deals directly with two separate segments: advisers, and customers. Technology systems are being used, but are oriented towards distribution or self-service, and don’t provide much information back.

In a digital world, however, the model most beneficial to companies looks closer to a centralised and connected network between all stakeholders:

2. Is this change even possible?

Long before COVID struck, the financial advisory space was trying to adapt digitally – with only marginal success. To capture the full gains of digital relationship-building, change needs to come from incumbents:

"Traditional insurers and wealth companies will never be pure digital players. It's like Tesco trying to create Amazon. In a world full of digital, they have never needed the agents and advisers more. And the same is true for the advisers who rely on the incumbents to help them transform."

Arik Yogev | CEO Ayalon Insurance (Israel)

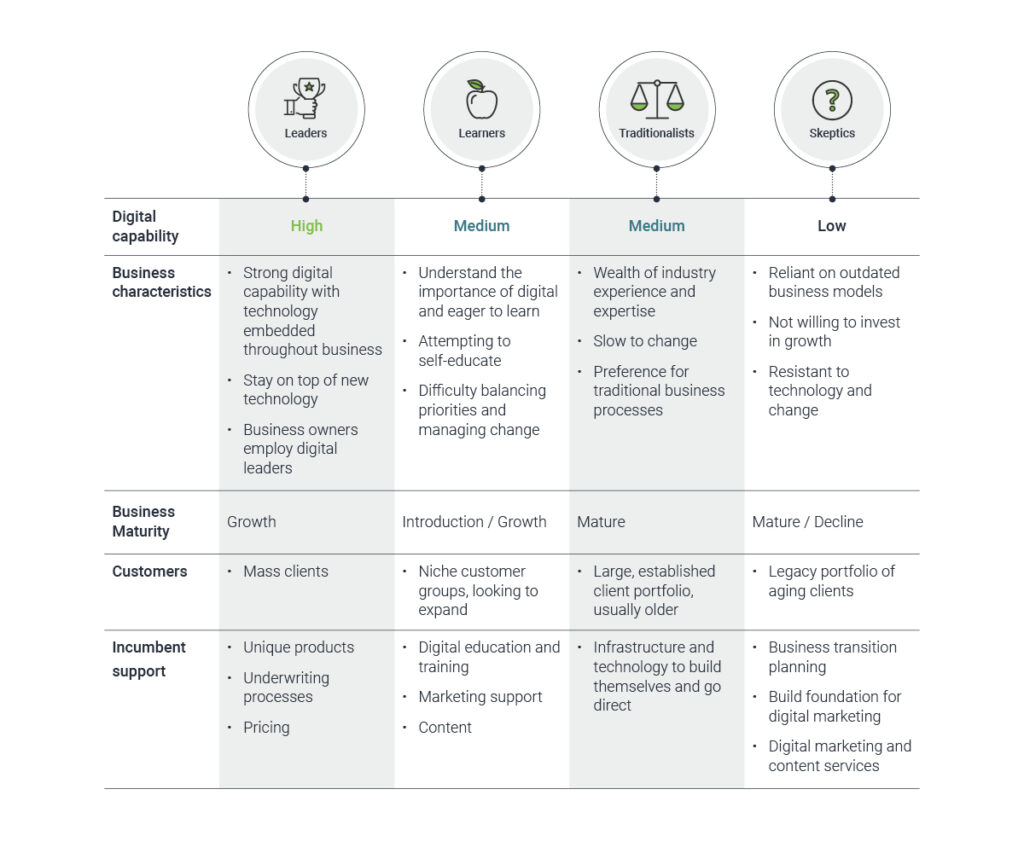

But beware treating advisors as a single cohort. Our work at Axell on segmenting this audience reveals they’re in fact split into four distinct categories: Leaders, Learners, Traditionalists and Skeptics.

Successful integrated solutions take these segments into account, and allow advisers to effectively manage workflows based on what the business agrees is important, not a specific individual, which makes for a consistent customer experience.

For product providers, this allows a tailored approach in managing advisers’ digital transformation. Not all advisers are at the same level of digital maturity, which means they require different solutions and support to help them evolve.

For example, TAL Life is a leading life insurer in Australia backed by Japanese parent company, Dai ichi Life. Chief Commercial Officer Tim Thorne has led the development of a digital marketing and content tool that allows IFAs to prospect and engage customers online. And he says:

"Advisers that transition to digital models see so much benefit - increased efficiency, better quality leads and greater client engagement that they of course never go back to the old ways."

Tim Thorne | Chief Commercial Officer, TAL Life Ltd (Australia)

3. FinTech bridges the skills gap

Our research reveals change is well on its way. We’re seeing technologies moving from B2C worlds into B2B2C, which creates a network effect for data and accelerating the transformation of large incumbents. It also allows technology partners to scale more quickly.

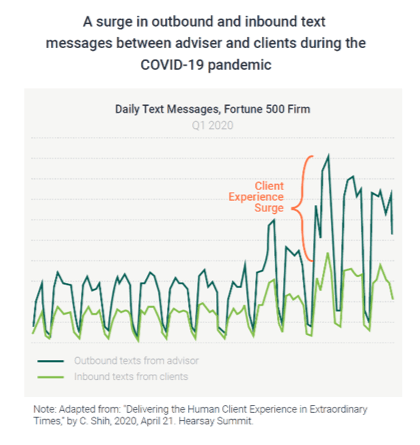

This has been put to the test by COVID. Hearsay Systems reports it’s seeing 40 times greater engagement when messages are sent from a trusted individual.

The company also shares data from one of its clients, a Fortune 500 financial-services company, showing how advisors were able to respond proactively to the new climate – with customers happy to engage.

Source: Hearsay Systems Summit 2020

Liri Halperin Segal is Co-Founder and CEO of LeO, an AI powered customer service solution tailored to the insurance industry. She says:

"Investing in digital can save operational costs, boost sales, and provide new leads. By doing that, you get valuable data that will help with better service and insights that will increase sales."

Liri Halperin Segal | CEO & Co-Founder, LeO

The “new normal” in financial advice distribution will be human connection at scale, enabled by technology. It requires leadership and an innovation mindset to get us there.

While incumbents have strategic advantages, for example scale and technical product expertise, digital solutions are best developed by digital natives.

FinTechs have moved from being perceived as a direct competitor, to a potential strategic partner.

There’s no going back from the changes we’re living through today, but we can use this opportunity to make positive, strategic decisions to set-up the industry for decades to come.

I’ve seen this taking shape in practice: over the past two years, Axell has worked with global financial services clients to transform distribution channels, create operational efficiencies and deepen customer value propositions.

We achieve this by connecting our clients to progressive FinTech start-ups, to deliver the desired digital transition.

The full report, Human Touch In A New Digital World, is now available.