We believe technology is changing the face of financial services, and to stay relevant, companies need to rapidly develop and implement innovative solutions.

That’s where we come in.

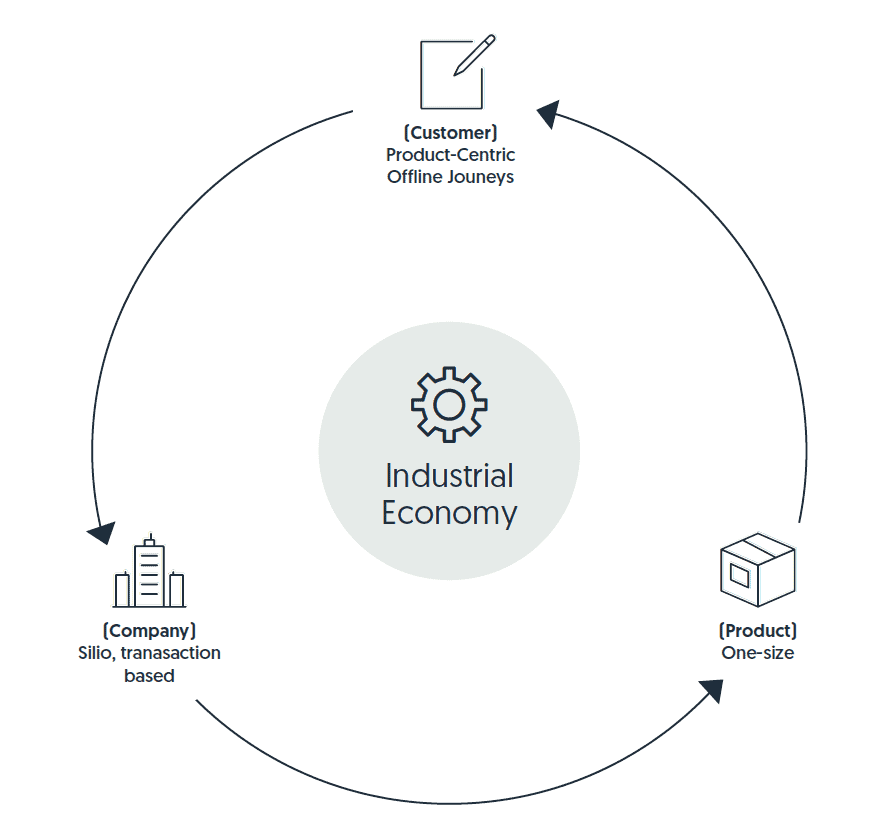

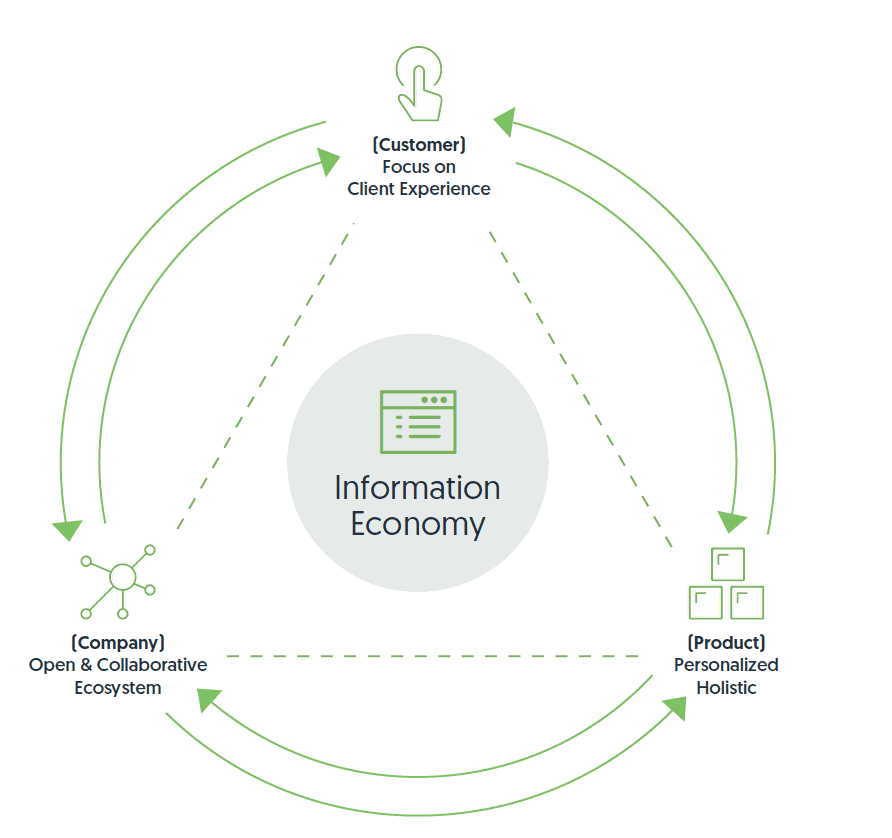

Technology is changing the way financial services are designed, consumed and delivered. New digital-first business models from products, operations to services – enabled by technology are fundamentally challenging incumbents in around the world.

To keep up with rapidly evolving technology, companies need to develop and implement new solutions quicker. We believe that future successful companies will be the ones who partner with the right digital companies at the right time to drive digital transformation and be ready for disruptive changes.

Using our long-term track record in financial services, we help senior management understand how technology and changing human behaviour impacts the future of their industry.

We take a personal approach to understand each business' unique challenges and work together to tailor solutions that align to strategic goals.

Our exclusive access to the technology ecosystem allows the synergistic application of insights and learning amongnon-competitive peers who face similar challenges.

We structure and build innovative digital businesses and enable transformation through a variety of engagement models.

Our exclusive innovation platform allows the sharing of insights and learning among non-competitive peers who face similar challenges. Headquartered in Tel Aviv, Israel, we accelerate the digital transformation by constantly innovating products and services from the insurance and financial sectors. Israel is one of the most vibrant and global innovation hubs, home of over 40 multinational financial services companies that engage with 500+ FinTech startups in the local ecosystem. Established companies from around the world come to Israel to open a local tech hub in order to stay at the forefront of innovation. By connecting our clients with the thriving Israeli innovation tech ecosystem, we help them move quicker than ever before.

I created Axell after working for over 20 years in financial services corporate roles at the forefront of digital transformation. My passion is helping businesses find opportunities, build new solutions and transform with innovation and cutting-edge technology.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

Moshe is the founder and CEO of Axell. With more than 20 years as an International innovator executive in financial services, Moshe has a proven track record in the successful implementation of global and local initiatives focused on digital transformation.

Moshe was Global Head of Digital Transformation at Generali, one of the world’s largest insurance companies. Prior to this, Moshe was Deputy CEO of Migdal Insurance, Israel’s largest insurance company. Moshe started his career at Intel Israel.

Moshe was a lecturer at Tel Aviv University and a board member in Anthemis group.

Expertise

Innovation & Design Thinking Principles

Venture Building

Global Insurance

Digital Transformation

Lyron is the CTO and senior advisor of Axell. He brings over 15 years of experience in successfully delivering innovative products to the financial industry with a specific focus on data-centric solutions.

Lyron has founded and managed Citigroup Technology Innovation Lab in Israel (200 engineers), including the creation of Citi’s first FinTech accelerator globally. Lyron has served recently as Chief Digital & Innovation Officer of Surecomp and prior to that as R&D director at SuperDerivatives (Now NYSE:ICE)

Lyron also serves as a senior FinTech lecturer at NYU Stern, Herzliya Interdisciplinary Center and as a guest lecturer at Jiao Tong Shanghai University.

Expertise

Tali leads the development of Axell’s Israeli technology ecosystem and strategic open innovation builds.

She is an experienced senior consultant in open innovation, new technologies, and start-up collaboration within the financial services and high-tech industries.

Tali also lectures at Dauphine-Mines ParisTech (École des mines) in the Master of Science in IT faculty.

Tali holds a Doctorate in Business Administration, Strategy, and Open Innovation from PSL Université Paris Dauphine.

Expertise

Bianca heads up Axell’s Australia and New Zealand operations as well as supports the company’s global marketing strategy.

Previously, Bianca held roles in innovation, digital transformation and marketing across the life and health insurance, and home lending industries within Australia.

Bianca has university qualifications in business and journalism and is currently undertaking further studies in psychology.

Expertise