No second chance to make a first impression

Successful customer onboarding is the equivalent of making a good first impression. Customers remember positive onboarding experiences and look for similar experiences with other companies and products. Consumers today compare and contrast their experience using products that are categorically different. Hence, onboarding experiences on platforms like Facebook, Google, and Amazon set the bar for other, more traditional industries like financial services.

Covid 19 – 2 years of digital transformation in less than 2 months

Despite over a decade of transformation, financial services and more specifically insurances and wealth management are still ranked relatively low in terms of the quality and availability of digital services. Conscious of customer expectations, Fintech and Insurtech companies have recreated this and have set the bar for banks, insurers, wealth managers, and other service providers.

The transformation has received a huge boost from the COVID-19 pandemic as governments, businesses, and individuals have quickly found alternatives to in-person interaction. Mass adoption of digital processes and onboarding is now a fact.

Digital onboarding will be the “new normal“

Digital onboarding in financial services is becoming more and more frequent. Processes like opening a digital wallet on PayPal, WeChat, or Google Pay, taking a loan on Amazon or Alibaba, buying bitcoin and other cryptocurrencies, transferring money overseas, purchasing life insurance, changing your beneficiaries, receiving claim payments, investing in a mutual fund, and even opening a savings account can now be done digitally.

Relatively recent progress in artificial intelligence has made fully compliant digital onboarding possible both from business and technology point of view. Regulators convinced to approve these processes. A typical onboarding process includes several steps of data collection and validations. Some of the data is provided by the customer and other sources of data are used for validation or for completing the application. Most of the data is text, but it can also include images, videos, and even voice recordings.

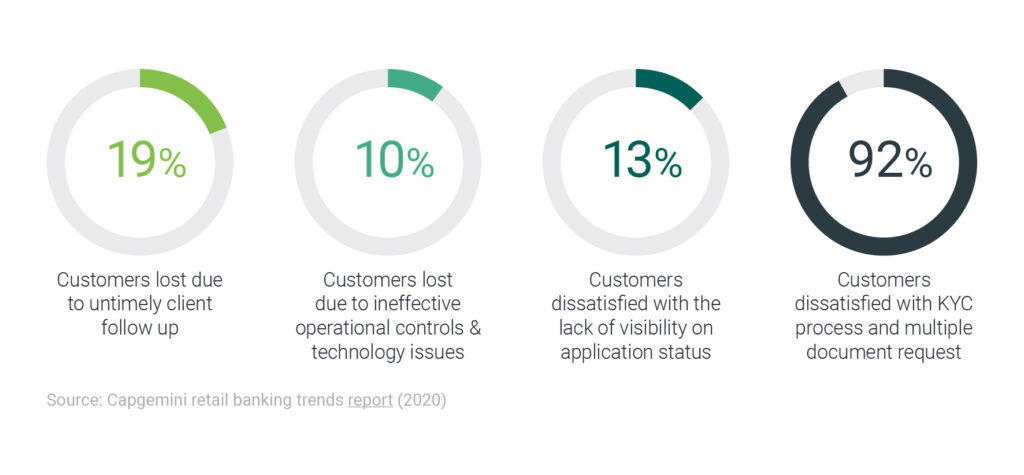

Measuring the success of digital onboarding

How can companies measure their success when creating a seamless, digital onboarding experience for their customers? The most important factor is a best-in-class user experience. UX evaluation is tricky and has some subjective elements. Intuitive processes that require minimal support and minimal customer effort (e.g. repeated input of data, automatic data capture, streamlining across verticals, automatic event triggering, etc.) are essential. The other main measures include speed, transaction costs, scalable solutions, and risk management.

Implementation isn’t easy, but it’s possible

While financial institutions know they need to offer customers a great user experience, this transformation can’t come at the expense of greater risk and higher costs. Despite the importance of digital onboarding in attracting and keeping customers, implementation is challenging given:

- Ever-changing regulatory requirements.

- The need to maintain a reasonable cost per process.

- Organizational complexity with many stakeholders involved in a single process.

- Tech-intensive process.

- Multi-stakeholders management inside the organization.

Israel fintech and regtech are powering the Revolution

Given the technologies required to digitize onboarding, it’s no surprise that multiple Fintech and Regtech success stories are coming from Israel, the startup nation. A number of companies are offering innovative solutions ranging from automatic ID verification and authentication to platforms that perform enhanced due diligence processes.

Companies like Scanovate, Au10Tix walkme are just a few examples of the different solutions provided by Israeli tech to support the collaboration and transformation of traditional financial services incumbents in their digital onboarding journey.

Our vision

We believe that future successful companies will be the ones who partner with the right digital companies, at the right time to drive digital transformation and be ready for disruptive changes. That’s where we come in. We have successfully implemented our client’s digital onboarding processes with our tech-partners.